Introduction: How HNIs Discover Real Investment Opportunities Today

High Net Worth Individuals no longer rely on traditional advisors or generic financial blogs to deploy capital. When an HNI searches online, the intent is clear and decisive—to find credible, exclusive, and actionable investment opportunities for HNI that are backed by data, access, and professional validation.

The modern HNI looks for deal flow, not theory. This shift has led to the rise of curated platforms that evaluate, rate, and distribute high-quality investment opportunities. American Ratings – Lead Magnet Portal has emerged as a structured ecosystem that aligns perfectly with this demand by combining investment ratings, opportunity access, and a sales partner point-based program.

This article explores how investment opportunities for HNI are evolving, what categories matter most, and why American Ratings is becoming a preferred gateway for both investors and sales partners.

Understanding the HNI Investment Mindset

HNIs differ from retail investors in three fundamental ways:

- They prioritize access over abundance

- They focus on risk-adjusted returns, not guaranteed returns

- They value independent validation before capital allocation

When HNIs search for investment opportunities for HNI, they are typically ready to evaluate live opportunities rather than consume educational content. This makes the keyword highly commercial and conversion-driven.

Core Categories of Investment Opportunities for HNI

1. Private Market Investments

Private markets are central to modern investment opportunities for HNI. These opportunities provide early-stage or growth-stage access that is unavailable on public exchanges.

Key formats include:

- Growth equity investments

- Strategic buyouts

- Sector-focused private deals

Private investments offer valuation arbitrage and long-term upside, especially when entered before institutional capital.

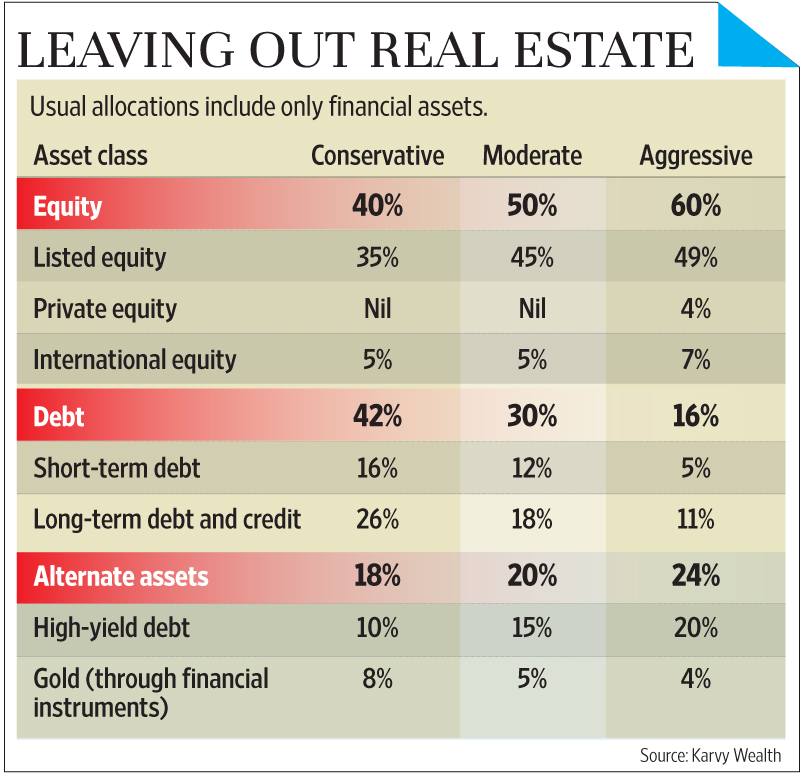

2. Alternative Investment Structures

Alternative investments form a major allocation bucket for HNIs seeking diversification beyond equity markets.

These include:

- Private credit structures

- Special situation funds

- Asset-backed opportunities

- Structured yield instruments

Such investment opportunities for HNI are designed to optimize downside protection while targeting above-market returns.

3. Pre-IPO and Unlisted Equity Opportunities

HNIs actively track unlisted companies with strong fundamentals and IPO potential. These opportunities are attractive due to:

- Entry at pre-public valuations

- Defined exit visibility

- Short-to-medium investment horizons

Platforms like American Ratings add value by rating and screening such opportunities before presenting them to investors.

4. Real Asset and Fractional Ownership Models

Real assets remain a preferred investment opportunity for HNI due to tangible value and predictable income.

Common formats include:

- Commercial real estate

- Warehousing and logistics assets

- Fractional ownership of premium properties

Professional management and transparent cash flow models make these investments suitable for long-term wealth preservation.

5. International Investment Exposure

Global diversification is no longer optional for HNIs. International investment opportunities allow:

- Currency risk hedging

- Access to stable foreign markets

- Participation in global innovation cycles

These investment opportunities for HNI are typically structured through compliant cross-border frameworks.

Why Ratings Matter in HNI Investment Decisions

HNIs rely heavily on third-party validation to reduce bias and information gaps. This is why investment ratings are becoming critical in the decision-making process.

Ratings help evaluate:

- Governance standards

- Financial stability

- Risk-return balance

- Scalability potential

This approach transforms investment discovery into a data-backed process rather than a sales-driven pitch.

American Ratings: A New Standard for Investment Opportunity Discovery

American Ratings operates as a Lead Magnet Portal focused on structured discovery of investment opportunities for HNI.

Instead of promoting products, the platform:

- Rates investment opportunities

- Filters high-quality deal flow

- Connects serious HNI investors with vetted opportunities

- Enables monetization through a sales partner ecosystem

Lead Magnet Portal: Turning Search Intent into Qualified HNI Leads

The Lead Magnet Portal is designed around high-intent search behavior, especially for keywords like investment opportunities for HNI.

Key features include:

- Opportunity-focused landing pages

- Rating-based comparisons

- Clear qualification funnels

- Investor readiness assessment

This ensures that only serious HNI prospects enter the ecosystem.

Sales Partner Program: Performance Driven, Point-Based

American Ratings offers a Sales Partner Program that rewards contribution and performance rather than simple referrals.

How the Point System Creates Value

Sales partners earn points for:

- Introducing qualified HNI investors

- Closing rated investment opportunities

- Supporting repeat investor participation

Points translate into:

- Revenue sharing

- Higher partner visibility

- Access to premium opportunities

- Long-term partnership benefits

This creates a scalable and transparent growth model for partners operating in the HNI investment space.

Why Sales Partners Choose American Ratings

Sales professionals and consultants prefer American Ratings because it solves three major challenges:

- Trust Deficit – Rated opportunities improve credibility

- Low Conversion – High-intent leads increase closure rates

- Scalability Issues – Point-based rewards encourage long-term engagement

The platform allows partners to focus on relationship building, while the system handles evaluation and qualification.

SEO Strength of “Investment Opportunities for HNI”

From a search perspective, investment opportunities for HNI stands out because it:

- Indicates immediate commercial intent

- Attracts decision-makers, not browsers

- Has strong lead-to-conversion potential

This makes it an ideal keyword for platforms like American Ratings that operate at the decision and action stage of the investment journey.

How HNIs Assess Opportunities Before Investing

Before committing capital, HNIs typically evaluate:

- Risk transparency

- Exit mechanisms

- Regulatory structure

- Independent ratings

- Long-term alignment

American Ratings integrates these evaluation parameters directly into its platform, reducing friction and accelerating decisions.

The Future of HNI Investment Platforms

The future of investment opportunities for HNI will be shaped by:

- Platform-led deal discovery

- Independent rating frameworks

- Co-investment ecosystems

- Performance-based partner models

American Ratings is positioned at the intersection of these trends, offering a future-ready investment access infrastructure.

Conclusion: A Smarter Way to Access Investment Opportunities for HNI

In today’s competitive capital landscape, simply searching for investment opportunities for HNI is not enough. Success depends on access, validation, and structured execution.

American Ratings delivers this by:

- Curating and rating high-quality opportunities

- Converting high-intent search traffic into qualified HNI leads

- Empowering sales partners through a point-based program

- Creating a transparent, scalable investment ecosystem

For HNIs and partners alike, this represents a strategic shift from product selling to opportunity-led wealth creation.

Leave a Reply